Preface

Google Finance announced the retirement of it's portfolio tracker in the summer of 2017. This blog gathers it's data and graphs exclusively from Google Finance and with the deprecation of the portfolio management, updates to this blog will also come to an end.

I still haven't found another free portfolio tracker on the web, but I will continue to look and maybe one day I can continue my portfolio updates.

I have managed to capture the portfolio data this one last time before it all vanishes, so here is the final post for this blog.

Portfolios

May 2014

All stocks are showing positive returns, majority with double digit gains. Best Stocks: GC 101% and GIB.A 85%.

YTD returns of the portfolio are 33%. On the initial investment of $35,262, the portfolio is now worth $47,975, an increase of $11,643. Dividends accrued is $1070.

Annualized ROI is approx 9% year over year for the past 3.5 years, inclusive of dividends.

M2014 portfolio returns of 36.3% as compared to TSX 10.7% over the same period. Pretty much outperformed the Toronto Stock Exchange over the entire period.

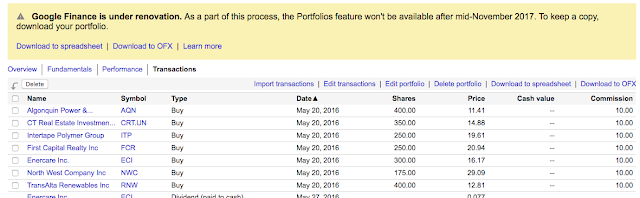

M2014 transaction data captured for future reference.

May 2015

The M2015 portfolio is also showing positive returns on all it's stocks. Every stock return is in the double digits. Best stocks of this portfolio are ATD.B 35% and NA 31%.

Total investment of $13,233 now has a value of $18,621 for a gain of $3009. Portfolio return is 23.19% excluding DH and 15% adjusted for DH losses. DH residual value and dividends totalled $2319.

The performance graph for the M2015 portfolio shows a total 21.9% return inclusive of dividends (includes DH loss). This portfolio is also at an all time high.

During the past 2.5 years, the M2015 portfolio 21.9% outperformed the 7% returns of the TSX.

May 2016

With the exception of CRT.UN, all stocks are in positive territory. Best performing stocks in this portfolio are ECI 24% and AQN also 24%.

Total investment of $35,045 is now worth $41,217 that includes dividends of $2578 and gains of $3593. Portfolio gain is 10.25%.

Total portfolio gains amount to $6172 for a year over year annualized return of 11.15% over the past 1.5 years.

The M2016 portfolio peaked in June 2017, but is now back near it's high. The total return is 17.85% inclusive of dividends.

The TSX was much stronger over the past 1.5 years with a solid 15.42% return. The M2016 portfolio managed to just better it at 17.8% as you can see from the graph.

May 2017

The M2017 portfolio is definitely not performing as desired, losing about 2.5% year to date. Initial cost of this portfolio was $17,327 but it is only worth $16,983 giving a loss of $429.

Best performers of this portfolio are TSGI at 21.4% and RCH at 11%. The big drags on this portfolio are UNS down 29.47% and CAS down 22%.

We are about two thirds into this portfolio's lifespan and it is showing -3.3% ROI.

With the small amount of dividends this portfolio has generated, it reduces it's overall loss to -1.6%. It has never shown a profit to date.

The M2017 couldn't even beat the lacklustre performance of the TSX's 3.37% and the performance deficit appears to be widening.

The transaction data for M2017.