May 2014

The overall return of the M2014 portfolio is just under 8%, averaging about 4% per year. Losing stocks are WFT, LNR, STN and EQB. GIB.A two year return is 73%, nice. GC and GIL round out the other winners with 42% and 33% gains respectively.

This is the performance graph since inception. 2016 is on track to be a tepid year for this portfolio.

The M2014 portfolio performance graph above as compared to the Toronto Stock Exchange for the same period. According to Google Finance, the portfolio is doing 10% better than the TSX, which has been essentially flat for the past two years.

May 2015

DH continues to struggle with it's stock now down 28%, but thankfully ATD.B is up 40% in our M2015 portfolio. EMA and WPK are giving decent double digit returns for the year. T, NA and SJ are more or less even. The return for this portfolio after 15 months is 5%, which is just OK.

M2015 portfolio performance graph will hopefully continue it's upward movement.

It's interesting to point out that the M2015 to TSX performance differential of about 10% is about the same as the M2014 vs. TSX. Different timeframes (2 years vs 1 year) , but same relative performance. You can see that the TSX was down close to 20% this past winter, but has now recouped it's losses.

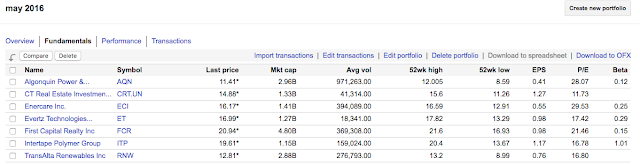

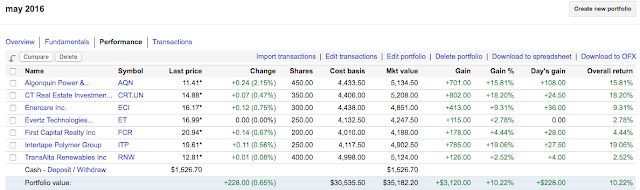

May 2016

The newest portfolio is now showing a 7% return after 3 months. The dividends returned is about 1% this quarter, so we are on track for a 4% overall dividend yield. So far, no losers in this basket, but the last minute pick of NWC is just treading water right now. The rest of the stocks are doing well, so I'm hoping it will continue it's performance into next year.

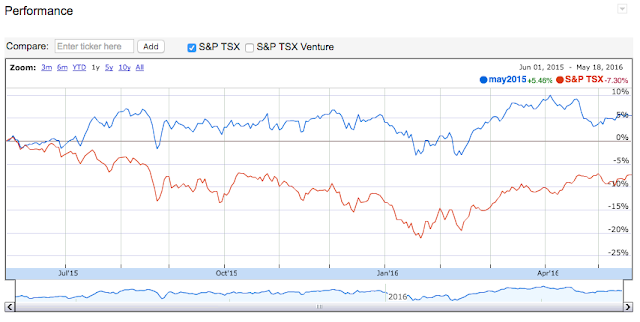

Overall the performance graph of the M2016 portfolio looks great, but it looks like it's due for a downturn in the next few months.

Since May of this year, the TSX has increased by about 5% and the M2016 portfolio is doing just a bit better at 7%.

NWC vs. ET

If you read my previous post, you'll know I originally had Evertz Technology ET in the M2016 portfolio and then I replaced it with NWC. Comparing the performance of the both stocks reveal that they both kinda suck, although ET did move up 8% in the month of June only to give it all back later.

So I went back and reviewed the 5 year stats for ET and it's showing 45% return. Did I look at the wrong graph back in May 2016 because I thought it had a much weaker 5 year return?

Here's the 5 year return graph for NWC, also showing a return of 45% over 5 years. Heh, these two stocks are almost identical in performance and fundamentals.

And here's a poo emoji, just because.