Recently a friend had asked me what to do with a small sum of money he had available to invest. I suggested that he try investing in the stock market. He's a cautious person so his obvious inclination was to put the money into GICs. That would be all well and good if the prevailing GIC rates of returns exceeded that of the Cost of Living.

My experience is that if you put your money into savings or GICs you are actually losing money, not making it. So I wanted to show the difference of putting money into quality stocks versus putting the money into a savings account, GIC, or mutual fund. Hence this blog. The purpose of this blog is to make an educated selection of fairly low risk, high quality stocks. To test that premise I create a model portfolio and track it's performance month to month.

If you came to this blog from a discussion with me, you'll know that I don't have a professional background in finance. Heck I don't even have a university degree. So please use your own judgement when reviewing this blog and make your own prudent financial decisions based on your own tolerance of risk.

So regarding Savings accounts and GICs....

If you put your money into a high interest savings account, you'd be lucky to get 1% interest per annum from your financial institution.

If you decided to buy a GIC instead, you might get 2% per year but that would depend on the term of the GIC and the amount to be invested. And there's a commitment to lock-in your money to get the promised rate of return. If you need to withdraw the money before the end of the term, you would forfeit any interest gained up to the point of withdrawal in many cases.

But, the cost of inflation, which is the rising costs of goods, increases by an average of 3% per year. So just to keep up with the cost of living your investment return would need to be 3%. That's just to keep your head above water. At 3% you wouldn't be growing your money at all.

If you see a financial adviser, they will most likely steer you in into mutual funds. These are commission based funds that are baskets of stocks selected by investment analysts. There are a plethora of mutual funds offered by every financial institution, all of which have hidden fees or commission loadings. Typically those fees amount to about 2-3% of the fund value.

Your financial adviser may suggest a mutual fund that might have returns of say 7-10%, which on the surface is pretty decent, until you deduct the cost of the management fees called MERs. With mutual funds or stocks there is no guaranteed return as there is with GICs. So a mutual funds historical value might not reflect the current rate of return because the analysts may have changed the holdings inside the fund.

So if you assume that a mutual fund has a projected return of 8% say, you still have to deduct off the MER of 3%, giving you a net gain of 5%. But again you have little control what's going on with the fund holdings. The good thing is you can move your money out of mutual funds fairly easily.

So what's left? Well i have heard of coporate bonds, but I don't know much about how to invest in them and I haven't done any research on it, so consider me clueless on that topic.

When should I start investing?

Now. Not tomorrow, not next week or next year. Because the longer you procrastinate the less time you have to make money. I think the hardest thing for people to get their head around is, how much money do I need to retire? It's not as hard as it seems to calculate the number, although you might be in for a shock.

Let's throw some numbers around for fun...

First, figure out what your lifestyle expenses are as they are right now. Do you know how much you pay for your home insurance, car insurance, rent, food, utilities like electric and water, gas for the car, heat for the house, entertainment, internet access, phone bill, etc, etc. You should try to figure this out on an average monthly or yearly amount. Don't forget to add the monthly credit card charges also. You don't have to be exact but it's safer if your numbers are higher than lower.

Ok, so let's assume you just did the math and find out that you have to fork out say $40,000 a year. If that's also your salary, then you're in big trouble because you are spending more than you make. Don't forget income taxes that end up reducing your gross income.

Next, let's assume you are 30 years old and still single for purposes of this discussion. And you plan to retire at 65 and maintain your current lifestyle. Now if you're male in fairly good health, you have a life expectancy of 75 to 85 let's say. Feel free to google the current mortality rates for North American men. So after you retire, you can expect to live another ten to twenty years. For sake of argument let's say twenty years.

So to hang around for 20 years at today's living expenses of 40K, you get about $800,000 present value. But the reality is the cost of living keeps rising every year by 3%.

Let's figure how much $40,000 will really cost when you hit 65

http://www.vertex42.com/Calculators/inflation-calculator.html

So from the time you are 65 until you hit 85, that's 20 years. From a simplistic standpoint, not accounting for the increasing inflation from yeas 65 onwards, you will need

$122,155 x 20 years = $2,251,100.

So to summarize you need to have 2.25 Million dollars at the age of 65 to survive your retirement years based on lifestyle you are maintaining presently. If you spend more in your later years of your working life, expect that you will need even more at retirement.

So, now we have a target to work towards. You are 30 years old today and you will need close to $2.3M to retire comfortably. Does this number freak you out? It should. It should make you have cold sweats and keep you up at night. Because the longer you wait, the less time you have time to save money.

Ok, now what?

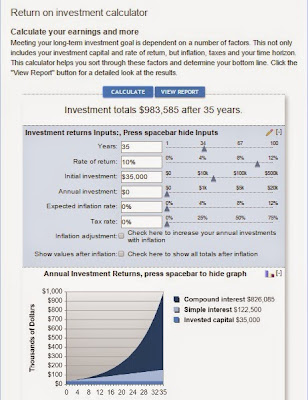

This is where our hypothetical portfolio comes in. If we invest $35,000 today and we get a 10% annual return, after 35 years, it will be close to $1M, excluding cost of living, etc, etc.

If I play with the percentage return and make it 15%, it becomes over $1.1M. Now this is assuming we put $35,000 and nothing else.

http://www.bankrate.com/calculators/retirement/roi-calculator.aspx

But what if we have $100,000 to invest initially at 10%? The end result? $2.8M.

So what that tells us, if you can keep investing over time, the end goal is achievable. Even if you don't have $100,000, if you start with something like $35K and keep trying to save a little more each year, it would be the same as if you put the $100,000 up front.

Finally, Here's what the experts say ...

https://ca.finance.yahoo.com/news/yes-save-1-million-retirement-193000782.html

No comments:

Post a Comment