With the recent gains and hoopla surrounding Toronto real estate, I started to wonder, would it have been better to hold stocks or real estate in the past 5 years. I say 5 years because it sort of corresponds to the amount of time I have been tracking the model stock portfolio performance. I did a google search on Toronto house prices over the past 5 years and came across this article from the Toronto Star dated Tuesday April 18, 2017.

http://www.ctvnews.ca/canada/in-charts-tracking-house-prices-in-canada-s-hottest-housing-markets-1.3373632

Now, just in case they retire the story, the article reviews home prices across Canada and they provide some statistical data. The first graph reviews home values in major Canadian cities in the first quarter of 2017.

A second graph looks specifically at Vancouver house prices vs. Toronto house prices.

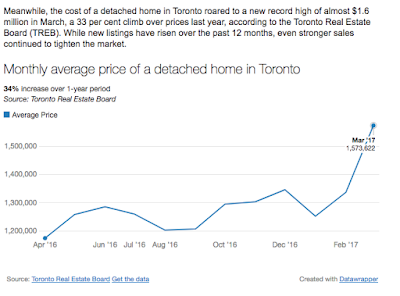

The third graph describes the current average home price of a Toronto detached home.

And finally, what I was really looking for, the 5 year monthly average price of a home in Toronto.

According to the article, they track the increase of the average Toronto home price from March 2012 to March 2017, and they show that home prices increased 62.5% over the past 5 years. I wanted to see what that looked like as a year over year increase so I arbitrarily picked the dates of March 1, 2012 and March 1, 2017 to plug into the ROI calculator. I used the starting price of $554,000 and a final price of $899,000 as per the data provided from the graph.

And here's the result. It shows that the money increased at a yearly rate of just over 10% year over year. That's pretty darned good. Ok, but we need to consider some things pertinent to this investment.

Consider if we were buying the property purely to flip over the five years. We would have made $345,000. However, we have to factor in the cost of buying the house, such as legal fees and closing costs as part of the initial purchase. Here's a list of typical closing costs:

http://www.themillsteam.ca/buying/costs-associated-with-buying-your-own-home/

So I'm going to plug some numbers in, based on the purchase price of $550,000. I'll use the low end of the ranges provided for purposes of this discussion.

Appraisal/Home Inspection: $500

High Ratio Mortgage: N/A (I'll assume we don't need this).

Combined Ont/Toronto Land Transfer tax: $550,000 x .04 = 22,000, then less $7050 = $14,950

Legal fees/disbursements: $1200

Title Insurance: approx $600

Adjustments: $400

Home Insurance: $1000

Buying cost Subtotal: approx $19,000

Then, we have ongoing costs of carrying and maintain the home over five years. This would include mortgage payments, utilities:

https://www.thestar.com/life/homes/2012/04/16/the_true_cost_of_home_ownership_ouch.html

The preceding article is probably a bit dated, but you get the point.

Property taxes: let's say $4000 per year - totally arbitrary

Condo fees: We'll assume a detached home so $0.

Ongoing maintenance and utilities: $100/month, so $1200 per year

Mortgage payment: I'll use an arbitrary number of say $2000 per month, assuming we have a decent down payment.

Ongoing cost subtotal: $4000 x 5 = $20,000, $1200 x 5 = $6000, $2000 x 12 x 5 = $120,000 =

$146,000

Ok, so then after 5 years, we decide to sell it for $899,000. Here's the costs associated with selling:

http://www.melissaemond.com/much-cost-sell-house-toronto/

According to the preceding article, the following costs are:

We will assume a principal residence, so no capital gains. $0

Legal fees: $1200

Real Estate commissions: 899,000 x 3% = $26,970

Selling cost subtotal: $28,170

Total costs over 5 years: buying + ongoing + selling = $19000 + 146000 + 28170 = $193,170!!!

This assumes that the property is not rented because it's our principal residence.

So, if we subtract the total costs of $193,170 from our profit of $345,000, that leaves us with a new sum of $151,830. That's our true return from this transaction. So now we take $554000, the original cost of investment and add $151,830 = $705830.

We take that number and plug it back into our year over year calculator and this is what we get:

The true return after 5 years is now 27.4 % with an average annual return of 5%.

Some other factors to consider: During this time, our investment was not liquid, ie: you can't just sell it right away. We considered this property as being a principal residence, but if it had been an income property, we might have rented it out for income over the past 5 years to offset the costs but it would have been subjected to capital gains tax upon sale.

So that was a look at holding some property for 5 years. Now, lets revisit one of our model portfolios - the oldest being M2014. It has a total return of 24% after 3 years.

So, let's plug in the current values of the model portfolio and see what our year over year return is.

We see a return of 7% year over year. If we take the 7% and apply it to the amount used to invest in real estate, ie 554,000, for the exact same time period of Mar 2012 thru March 2017, it would be worth ....

Stock investment over 5 years: $780,651, park it and forget it.

Real estate over 5 years: $705,830, buying, carrying and selling.

So, which would you choose?