M2014 Portfolio

Holdings and Performance

EQB is the only stock showing a loss, all others posting gains. GC continues to be the winner in this group with a whopping 127% return. Portfolio has increased in value $8075, posting a 22.9% gain.

Since inception, the graph shows a total portfolio return of 25.89% which includes dividends. This implies a dividend yield of about 3%. Over the same period of time, the TSX eked out a mere 4.66%.

Plugging the portfolio data into our ROI calculator, we get 7.1% annualized (year over year) return.

M2015 Portfolio

Holdings and Performance

Doing much better on this portfolio, everything is showing positive returns. SJ and T are giving us single digit returns, whereas the top performer WPK is up 32%. As I mentioned in my previous post, DH was bought out and is no longer traded on the TSX. We therefore experienced a loss of 37.5% on this stock before it stopped trading. With the loss of DH, the overall portfolio return is now 9.5%. The portfolio performance gain without DH is $2225 and up 16.8% , before dividends are factored in.

Despite the loss of DH, the M2015 portfolio is still far exceeding the TSX's overall return of 1.1%.

Factoring in dividends, the yearly return without DH is 13.6%.

M2016 Portfolio

Holdings and Performance

Starting to see a performance pullback in the M2016 portfolio. CRT.UN, FCR and ITP are laggards and in the red. Best performing stock of this group is ECI. Overall, the portfolio is up a modest 7.5%.

Interesting to note that the TSX rebounded in the past year posting a healthy return of 9%. With dividends, the M2016 portfolio managed to better the TSX return at 13.9%. The dividends generated are almost doubling the performance of this portfolio (7.5% vs 13.9%). Dividend yield is therefore 6.4%.

On an annualized basis, the M2016 portfolio is returning a respectable 10.4%.

M2017 Portfolio

Holdings and Performance

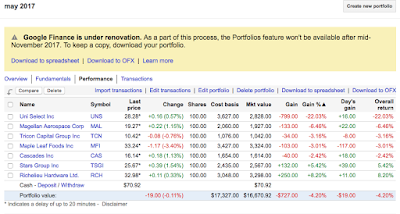

I think I accidentally deleted the screen shot for the M2017 holdings, so here is a more current one from October 15. The performance graph is accurate though. This portfolio has done poorly from the outset. From May through September is has continued on a downward trend. Almost all stocks are in a negative position with the exception of RCH. Worst performer is UNS down over 20%. In September this portfolio was down a staggering 8% for the past 6 months. I won't calculate the annual ROI until the portfolio has passed the one year mark.Summary

Portfolios and total overall returns (inclusive of dividend yield), at Sept 2017

May 2014 - 25.89% (up, previously 16.42% in May 2017)

May 2015 - 13.6% (down, previously 15.36% in May 2017)

May 2016 - 13.9% (down, previously 16.17% in May 2017)

May 2017 - (8%), down since portfolio inception

No comments:

Post a Comment